Understanding Inflation: A Breakdown of What Inflation and Interest Rates Are and How They Evolve Over Time

Inflation and interest rates are two essential economic concepts that significantly affect your purchasing power and savings. Inflation refers to the rise in prices of goods and services, leading to a decrease in the value of money. On the other hand, interest rates determine how much it costs to borrow money or how much you earn from savings. Both inflation and interest rates are interlinked, impacting economies and daily life in different ways. Let’s dive deeper into these concepts and explore their evolution over time.

What Is Inflation?

Inflation is the gradual increase in the cost of goods and services. As inflation rises, each unit of currency buys fewer goods and services than before. For example, if a loaf of bread costs ₹50 today, it might cost ₹52 in the future due to inflation. This means your money doesn’t stretch as far as it once did. In India, inflation is driven by several factors, such as food prices, fuel costs, and government policies. While a certain level of inflation is typical, excessive inflation can reduce people’s purchasing power, making it harder to afford essential items.

Why Does Inflation Happen?

Inflation doesn’t occur randomly. It can be caused by several factors:

- Demand-Pull Inflation: When the demand for goods and services exceeds supply, prices go up. This type of inflation is common when the economy is growing fast, and people have more money to spend.

- Cost-Push Inflation: This happens when production costs rise due to higher raw material or labor costs. Companies pass on these costs to consumers by raising prices.

- Monetary Policy: Central banks, like the Reserve Bank of India, manage inflation through interest rates. By controlling the money supply, they try to keep inflation in check.

Understanding the reasons behind inflation can help you make informed decisions about your money.

How Inflation and Interest Rates Work Together

Inflation and interest rates are closely connected. Central banks use interest rates to control inflation. When inflation is high, central banks often raise interest rates to reduce spending and borrowing. This can help slow down the economy and bring inflation back to a manageable level.

Conversely, when inflation is low, central banks may lower interest rates to stimulate spending and borrowing. Lower interest rates make it easier for people to borrow money, which can increase demand for goods and services, leading to mild inflation. By adjusting interest rates, central banks can influence both inflation and economic growth.

A Comparison of Inflation and Its Impact in India, Pakistan, Bangladesh, China, and the USA

Here’s a table comparing inflation rates in India, Pakistan, Bangladesh, China, and the USA. This comparison helps you understand how inflation differs from country to country:

| Country | Inflation Rate (2025 Est.) | Impact on ₹100 (in INR) | Example of Affected Goods |

|---|---|---|---|

| India | 5% | ₹105 | Food prices, fuel, healthcare |

| Pakistan | 7% | ₹107 | Essentials like gas, food items |

| Bangladesh | 6% | ₹106 | Rice, edible oils, transportation |

| China | 3% | ₹103 | Basic food, tech products |

| USA | 4% | ₹104 | Gasoline, groceries, housing |

As shown in the table, inflation rates are different across countries. In India, the inflation rate of 5% means ₹100 will become ₹105 in a year. In countries like Pakistan and Bangladesh, higher inflation rates can lead to more noticeable price hikes. Meanwhile, inflation in China and the USA is expected to be lower, resulting in slower price increases.

The Impact of Inflation in India Compared to Other Countries

Inflation in India is expected to rise moderately. Here’s how India’s inflation compares to other countries:

| Country | 2025 Inflation Rate | Comparison to India |

|---|---|---|

| India | 5% | Standard inflation for the economy |

| China | 3% | Lower inflation than India, meaning less price increase |

| USA | 4% | Slightly lower than India’s, slower price increase |

| Pakistan | 7% | Higher inflation than India, leading to higher costs |

| Bangladesh | 6% | Higher than India, affecting living costs more |

Inflation in India is expected to be moderate compared to countries like Pakistan and Bangladesh, where inflation is expected to be higher. On the other hand, China and the USA have lower inflation rates, leading to more stable prices for consumers.

Managing Inflation and Interest Rates for Personal Finance

Inflation can significantly impact your finances. To manage inflation effectively, consider the following tips:

- Invest in assets that outpace inflation, like real estate or stocks.

- Diversify your savings to include inflation-proof assets such as gold.

- Monitor interest rates—when they rise, borrowing becomes expensive, so it may be a good time to reduce debt.

By staying informed about inflation trends and interest rate changes, you can make smarter financial decisions. Understanding these concepts will help you prepare for the future and protect your wealth as inflation continues to evolve.

Rising Costs: How Inflation Leads to Higher Prices for Everyday Goods

Inflation can be a major concern for consumers. The prices of everyday goods—such as food, transportation, and utilities—can rise steadily over time, causing a strain on personal budgets. It happens when the overall cost of living increases, making money less valuable and pushing the cost of essential items higher. Interest rates also play a big part in this process, as central banks raise rates to control inflation, which, in turn, can affect borrowing and spending behaviors. But how exactly does inflation cause the cost of daily items to rise? Let’s break it down and take a closer look.

The Basic Concept of Inflation and How It Impacts Prices

At its core, inflation happens when the demand for goods and services outstrips supply. This creates upward pressure on prices, causing things to cost more. The general idea is simple: when inflation rises, the purchasing power of your money falls. In other words, your ₹100 won’t buy you as much as it did before. Over time, even small price increases can add up, making it harder to stretch your budget across everyday expenses.

This means that inflation directly impacts the prices you see at grocery stores, restaurants, gas stations, and even your utility bills. As the cost of producing goods rises (due to higher labor and material costs), companies pass on these higher costs to consumers. That’s why, when inflation increases, you often notice the rising prices of food, fuel, and even services like healthcare.

How Inflation Affects Common Goods and Services

You might have already felt the pinch of inflation in your own daily purchases. Whether it’s the cost of milk, bread, or your commute, everything seems to cost a bit more. So, how exactly does this happen? Let’s take a closer look at some of the everyday goods that are affected by inflation.

Food Prices

Food is one of the first places you’ll notice inflation. As the cost of agricultural production goes up, grocery prices follow suit. The price of fruits, vegetables, dairy, and even packaged goods increases because it costs more to grow, transport, and store these items. Additionally, weather patterns, such as droughts or floods, can disrupt supply chains and further drive up prices. As inflation increases, you might find yourself spending more money on fewer items, which can have a significant impact on your monthly grocery bill.

Gasoline and Transportation

Gas prices are another area where inflation can hurt your wallet. When inflation rises, the cost of crude oil also tends to increase, leading to higher gas prices. This means that getting to work, running errands, or traveling can cost more. Moreover, as transportation costs rise, the prices of goods that rely on transportation to reach consumers—such as electronics, clothing, and furniture—also increase.

Healthcare and Utilities

Healthcare and utility bills are also affected by inflation. Medical costs, including doctor visits, medications, and hospital care, become more expensive as inflation increases. Similarly, your electricity, water, and gas bills might see a rise as companies raise prices to cover higher production costs.

A Quick Comparison of Inflation’s Impact on Everyday Goods

To make it even clearer, here’s a table comparing inflation’s impact on common household items. This table will give you a better understanding of how inflation changes prices in different areas of life:

| Item | Price Today (INR) | Inflation Impact (2025) | Price After Inflation (INR) |

|---|---|---|---|

| Milk (1 liter) | ₹55 | 6% | ₹58.30 |

| Bread (1 loaf) | ₹35 | 5% | ₹36.75 |

| Gasoline (per liter) | ₹110 | 8% | ₹118.80 |

| Monthly Electricity Bill | ₹1,200 | 4% | ₹1,248 |

| Public Transport Ticket | ₹50 | 3% | ₹51.50 |

This table illustrates how inflation impacts essential items. As shown, even a small percentage increase in inflation can cause significant price hikes over time. For example, the cost of milk might only increase by ₹3 per liter, but this can quickly add up when you purchase multiple liters each week. Similarly, the price of gasoline and public transport also rise, affecting both individual commuters and businesses relying on transport.

Managing Inflation’s Impact on Your Budget

Now that you understand how inflation drives up prices, it’s important to know how to manage these changes in your daily life. Here are some tips to help you deal with the rising costs:

- Adjust your budget: Re-evaluate your spending habits and find areas where you can cut back. This might mean cooking more at home or finding cheaper alternatives to expensive items.

- Shop smarter: Look for discounts, buy in bulk, and choose store brands. Small adjustments can help you stretch your budget further.

- Consider investments: As prices rise, the value of money decreases. Investing in assets like stocks, bonds, or real estate can help protect your wealth from inflation over the long term.

Inflation is inevitable, but by staying informed and adjusting your spending habits, you can keep rising costs from taking too much of a toll on your budget. Monitoring the inflation rate and understanding how it influences prices will help you make better decisions for your finances.

Check Out These Related Articles:

Online Gambling in India: How Technology is Shaping the Future – Discover how technology is transforming online gambling in India and shaping its future.

Why the UK is Seeing a Boom in Online Casinos – Explore the factors behind the surge in online casinos in the UK and what makes the market thrive.

Why Online Betting is Gaining Massive Popularity in India – Learn why online betting is becoming a go-to choice for millions of players in India.

Interest Rates and Inflation: The Connection Between Inflation and Changing Interest Rates

Inflation and interest rates go hand in hand. You might not realize it, but the way the central bank adjusts interest rates has a direct impact on how inflation affects your daily life. When inflation rises, it often leads to higher interest rates, which changes how you spend, save, and borrow money. These changes aren’t just theoretical—they have real-world effects on mortgages, car loans, and even savings accounts. But how does this all work? Let’s break it down in simple terms.

What is the Relationship Between Inflation and Interest Rates?

To understand the connection between inflation and interest rates, it’s important to know what each of these terms means. Inflation is the rise in the price of goods and services over time, while interest rates are the cost of borrowing money or the return on investment you earn from savings. When inflation rises, central banks often raise interest rates to control it.

Why? It all comes down to managing economic growth. When inflation gets too high, it signals that the economy might be overheating. This means people have more money to spend, leading to increased demand for goods and services. If demand exceeds supply, prices go up. To slow this down, central banks raise interest rates, which discourages borrowing and spending.

How Higher Interest Rates Help Control Inflation

Higher interest rates reduce consumer spending and borrowing. When loans become more expensive, people are less likely to take out mortgages, car loans, or credit card debt. This slows down demand for goods and services, which can help reduce inflationary pressure. If you’ve ever been tempted by low-interest loans to make a large purchase, you’ve felt the opposite effect. When interest rates rise, it becomes less attractive to borrow money, and this can cool down inflation.

For instance, when the Reserve Bank of India (RBI) raises interest rates, it usually becomes more expensive to get a personal loan or mortgage. As a result, fewer people take out loans, and demand for goods and services may decline, which can help bring inflation down.

The Impact of Changing Interest Rates on Your Finances

Interest rates can affect your finances in various ways. From the loan you have to pay off to the money you’re saving, understanding how interest rates fluctuate due to inflation can help you make better financial decisions. Let’s take a look at some of the key areas affected by interest rate changes:

Mortgages and Loans

When the central bank raises interest rates to combat inflation, it impacts the rates on mortgages, car loans, and other types of credit. For example, a higher interest rate on your mortgage means you’ll end up paying more in interest over the life of the loan. Conversely, when rates fall, you might see lower monthly payments and reduced interest costs.

Savings Accounts and Investments

On the flip side, rising interest rates can benefit savers. Higher rates mean that you earn more interest on your savings, which could be a nice bonus if you’re stashing money away in a fixed deposit or savings account. However, if inflation is high and interest rates are lower, your savings may not grow fast enough to keep up with rising prices.

Borrowing for Big Purchases

Whether you’re looking to buy a car or take out a personal loan, rising interest rates mean borrowing becomes more expensive. This can discourage people from making big-ticket purchases. For example, a higher interest rate could make it less affordable to finance a car, as your monthly payments would increase. So, if inflation is high and rates rise, many might hold off on major purchases until conditions improve.

Inflation, Interest Rates, and Their Impact: A Simple Comparison

To help make sense of how inflation and interest rates affect your finances, let’s look at the table below. It illustrates how a change in interest rates can impact various aspects of your financial life, depending on whether inflation is low or high:

| Scenario | Low Inflation (3%) | High Inflation (8%) |

|---|---|---|

| Interest Rate | 4% | 7% |

| Mortgage Rate | ₹8,500 per month (₹4,00,000 loan) | ₹9,500 per month (₹4,00,000 loan) |

| Car Loan Payment | ₹5,000 per month (₹2,00,000 loan) | ₹6,000 per month (₹2,00,000 loan) |

| Savings Interest Rate | 3% | 5% |

| Personal Loan Rate | 9% | 12% |

From the table, you can see that when inflation is high, the interest rates tend to be higher as well. This means higher monthly payments on mortgages, car loans, and personal loans. At the same time, you might see a higher return on your savings if the interest rates rise in response to inflation, but if inflation is too high, your money may not grow fast enough to keep up with price increases.

What Should You Do in a High Inflation and High Interest Rate Environment?

Knowing how inflation and interest rates are connected can help you make smarter financial decisions. When interest rates are high and inflation is rising, here are a few things to consider:

- Refinance loans: If you have loans with high-interest rates, consider refinancing to lock in a lower rate before interest rates rise even further.

- Delay big purchases: If possible, put off making large purchases like cars or homes until interest rates are lower.

- Increase savings: Take advantage of higher savings interest rates by putting money into accounts or investments that benefit from rising rates.

- Manage debt wisely: Focus on paying off high-interest debt first, especially credit card balances, which are most impacted by rising rates.

By understanding the connection between inflation and interest rates, you can stay ahead of economic shifts and better plan your personal finances. Always stay informed and adjust your strategy as needed to minimize the impact of these changes on your wallet.

Inflation’s Effect on Your Budget: Practical Tips to Navigate Inflation’s Impact on Your Financial Planning

Inflation is something that can sneak up on you, leaving you with higher prices on everyday essentials. While inflation is a natural part of any economy, it can significantly impact your personal finances, especially when it comes to budgeting. When inflation rises, everything from food prices to gas costs tends to increase, making it harder to stick to your budget. However, understanding how inflation works and adjusting your financial plans can help you stay on track.

Understanding Inflation’s Impact on Your Budget

Inflation doesn’t just affect the price of a cup of coffee or the cost of gas at the pump. It influences the prices of nearly everything in the economy. So, when prices go up, your purchasing power decreases. This means that the money you have today won’t stretch as far tomorrow, even if you don’t make any changes to your spending habits.

As inflation increases, the cost of living rises, and the same amount of money you once spent on essentials no longer gets you as much. The more inflation affects the economy, the more you might need to adjust your budget. That’s where smart financial planning comes in.

Practical Tips to Adjust Your Budget in an Inflationary Environment

When inflation is on the rise, it’s important to look at your budget and make adjustments that align with your financial goals. Here are a few tips that can help you manage inflation’s impact and keep your financial planning intact.

1. Track Your Spending More Closely

The first step in battling inflation is understanding exactly where your money is going. Start tracking every expense to identify areas where you can cut back. Are there subscription services you don’t use or impulse buys that you don’t really need? By keeping an eye on your spending, you can make better decisions about where to allocate your resources.

For instance, let’s say that your usual grocery bill has increased. Keeping track of how much more you’re spending can help you decide whether you need to buy fewer premium items or choose more budget-friendly alternatives.

2. Review and Adjust Your Financial Goals

Inflation affects your purchasing power, and with rising prices, you might find it difficult to stick to your original savings or investment goals. This doesn’t mean you have to abandon them entirely, but it may require some adjustments.

For example, if inflation is driving up living costs, consider revising your monthly savings goal. While it’s essential to continue saving, you may need to reduce your contributions temporarily until things settle. On the other hand, if you’ve been relying on fixed savings accounts with low interest, inflation might make you rethink your options. Look into investments that could give you a better return to outpace inflation.

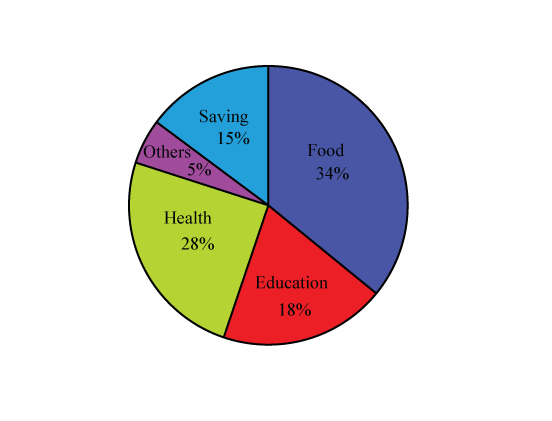

3. Prioritize Your Spending

During inflationary periods, not all expenses are created equal. When you’re reviewing your budget, it’s important to prioritize essential items and limit discretionary spending. For instance, if gas prices are rising, try to limit driving or carpooling more frequently. Focus on buying only necessary goods and delay any non-essential purchases until inflationary pressures ease.

Creating an Inflation-Proof Budget: A Simple Comparison

To help visualize how inflation affects your budget, here’s a table that compares typical spending categories before and after inflation. It highlights how you might need to adjust your spending to maintain financial stability during an inflationary period:

| Category | Before Inflation (₹20,000/month) | After 8% Inflation (₹21,600/month) |

|---|---|---|

| Grocery Shopping | ₹5,000 | ₹5,400 |

| Gasoline | ₹3,000 | ₹3,240 |

| Utilities (Electricity, Water, etc.) | ₹2,500 | ₹2,700 |

| Entertainment | ₹1,500 | ₹1,620 |

| Dining Out | ₹2,000 | ₹2,160 |

| Savings | ₹5,000 | ₹4,740 |

From the table, you can see how every expense increases with inflation. Notice that in the After Inflation column, you’re spending more on groceries, fuel, and even entertainment. It may not seem like a huge jump, but those extra ₹1,600 add up over time, making it harder to save.

Navigating Interest Rates in an Inflationary Environment

Interest rates also play a role in your budget during periods of inflation. When inflation rises, central banks often raise interest rates to slow down the economy. This can make borrowing more expensive, whether you’re looking to buy a home, car, or even get a personal loan.

For example, if you have a home loan, the interest rate on your mortgage might increase, causing your monthly payment to rise. This means you’ll need to adjust your budget to accommodate the higher payment. Similarly, if you’re planning on taking out a loan for a big purchase, be prepared for higher interest rates, which could increase the overall cost of your loan.

1. Consider Refinancing Options

If you have existing debt, consider refinancing your loans to lock in a lower interest rate before they increase further. Refinancing may help reduce the amount you pay in interest, even as inflation continues to drive prices up. This way, you can save money in the long run and ensure your budget remains manageable.

2. Adjust Your Savings Strategy

While interest rates may rise, you might want to consider moving your savings into higher-yield savings accounts or short-term bonds to keep up with inflation. If interest rates increase due to inflation, you can earn more interest on your savings and investments.

Mastering Your Budget During Inflation

Navigating the impact of inflation on your budget doesn’t have to be complicated. By tracking your spending, adjusting your financial goals, and making smart decisions about your savings, you can reduce the negative effects of inflation on your finances. Although inflation will likely continue to impact prices, a well-structured budget will help you stay on top of your financial goals.

Remember, inflation doesn’t have to be a financial roadblock. With these practical tips, you’ll be able to manage your budget effectively and keep moving toward your financial objectives, even in challenging times.

How Inflation Can Sometimes Be Good

While inflation is often seen as a financial villain, it isn’t always a bad thing. Moderate inflation—typically around 2% annually—is considered healthy for an economy. Why? For starters, it encourages spending. When prices are expected to rise slightly over time, people are less likely to hoard money and more likely to invest or make purchases, stimulating economic activity.

Inflation can also benefit borrowers. If you have a fixed-rate loan, like a mortgage, inflation reduces the real value of the money you owe over time. Essentially, you’re repaying your loan with “cheaper” money. Businesses, too, often see increased profits during inflationary periods because they can adjust their pricing while keeping production costs relatively stable.

Additionally, mild inflation helps prevent deflation—a scenario where falling prices can lead to reduced wages, lower spending, and an economic slowdown. By maintaining a balanced level of inflation, central banks can foster steady economic growth.

In short, while runaway inflation is harmful, controlled and predictable inflation is a sign of a thriving economy and can even work in your favor!